No matter how much you earn or save, it never seems enough. If you’re stuck on a low income, saving and meeting goals seem daunting. Forget thriving. One just tries to survive by ensuring the bare minimum. So, will the situation remain the same? Would you be able to earn more ever? The answer is yes, you can. There are some initiatives that you can take to improve the situation.

It grants you more control over your finances. So, if you struggle to relocate your savings well, the blog may help. It may assist you in budgeting, spending, and thriving well on a low income. Yes, it is possible. However, you must maintain financial discipline. You can do that easily with a budget planner. Let’s learn it all from the very blog.

What does a budget planner imply?

A budget planner is a tool that helps individuals map incomings and outgoings throughout the year. It helps analyse the amount you can save given current liabilities. You must check your banking statements, household utility bills, and receipts. Additionally, consider future investment contributions like- retirement funds, insurance, or other investments.

Accordingly, you can know the amount you can spend without worries. It also helps understand how increasing income may help savings. Precisely, it is the best way to re-track your finances. It helps nail every financial aspect. It includes- saving, investing, and spending.

What does a budget help you know?

Squeezed incomes affect the basic lifestyle. One struggles with rent, mortgage payments, and other requirements. Thriving under a cost-of-living crisis is further turmoil. This economic impact affects the goals and savings. Thus, budgeting here helps you know your affordability. It helps make financially wise decisions that protect the bottom line. It primarily answers the two big questions-

| Do I spend more than I earn? | What can I afford to spend? |

| If debts are higher than income, you spend more than you earn. A budget planner helps you address this. It provides a definitive assessment of where you spend the money. | When you know where you spend the most, you can curtail spending. It helps you understand and create a barrier as to how much you can spend given the liabilities. |

What should you consider while saving and spending money?

Yes, saving and spending account for major financial aspects. Thus, you must analyse and improve every penny that comes in and goes out.

| Aspects to consider while saving money | Aspects to consider while spending money |

| Identify whether you can save a particular amount without affecting liabilities. | Identify the urgency of the situation. Can you delay the spending? |

| Prioritise the life goals by splitting into small and long-term goals. Save for the immediate ones first. | Are you buying the product at the best affordable price? Does the product share long-term value? |

| Identify the best way to maximise the returns on investment. Yes, you can do that despite a low income. | Does your current big purchase affect other important life goals? |

| Saving for the long term must not affect current life needs | How will the expense affect emergency savings? |

For example- You encounter an emergency as a low-income earner. Identify the immediate ways to tackle it. Be conscious of spending more money than you need. If confused, consider instalment loans for help. The financial experts provide extra cash flexibility with such loans. They help you get only money that you would need for the cause. It prevents you from spending more. Moreover, it eliminates the worries of tapping bare minimum savings.

The best part about such loans is- fixed monthly payments. It proves a blessing for a low-earning individual. It does not trouble or clash with your finances. Instead, it helps ensure financial discipline.

How do you save and thrive on a low income without worries?

Now that you know the difference between saving, spending, and thriving, let’s move further. Thriving on a low income and saving might seem tasking. However, you can nail that aspect. Here is how:

1) Categorise your expenses

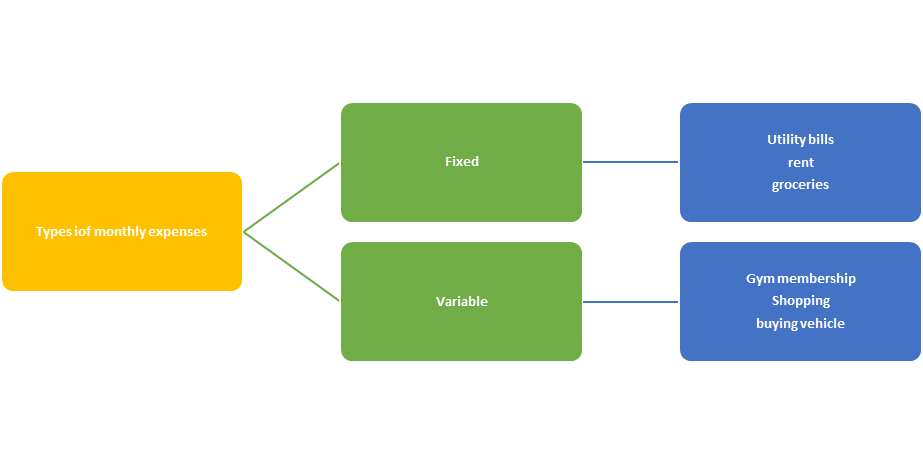

Thus, categorising your expenses into fixed and variable ones helps. It would help you analyse where you can cut on both. For example- fixed costs are generally critical to survival. You cannot cut it altogether, but reduce usage for savings. However, you can cut variable expenses like shopping, watching movies or massive purchases. Cutting or delaying such costs would help you save more and thrive peacefully.

2) Increase your earning possibilities

According to Turn2s reports, “You generally earn £296/week to be considered a low-income earner. It is as per the latest government analysis. Accordingly, the mean of such a household is £594/week.” You can see here that one can live on a low income. However, you cannot thrive well and achieve goals. Thus, try to improve your earning possibilities and boost your income.

Additionally, increasing or boosting salary is not always about fetching a high-paying job. It is also about leveraging the dues that you might have forgotten about. For example- check your tax codes if you are due a refund. Check whether you can claim the tax breaks if eligible. It helps meet household costs without worries.

Similarly, identify your dues on the other investments and returns. Identify your dividend count. It will help boost the income. You can re-invest some profits to gain higher returns later.

Alternatively, analyse the government benefits that you are eligible for. You may get help with renting, housing, food and utility bills. Check expert portals like MoneySavingExpert for detailed guidance on saving money on basic household expenses.

3) Try to prevent debt buildup

Managing debt is one of the most important aspects of saving and investing. You cannot approach other life goals with a neck-deep line of debts. Ignoring them will only worsen the situation. Identify expenses and draft a budget to settle these dues.

Yes, it is challenging to ensure that extra flexibility. Don’t worry. You can still manage that well. You don’t need to save for every single debt and pay. In that case, it may take you years to pay the dues. Instead, check the instant way to pay multiple debts. It will improve your financial standing and save money. Yes, such a strategy exists.

You can achieve it by considering debt consolidation loans for bad credit in the UK from a direct lender nearby. It will help you consolidate more than 7 debts into a single monthly payment. You may need it for low credit as individuals with multiple debts generally lack sound credit history. It is the easier way to manage debt and achieve other life goals. It reduces the interest costs, and you get the lump sum after consolidating. Save this amount towards the emergency fund for now. It will help you sustain and thrive on low income without worries.

- Try to manage your money well

Your efforts to increase savings and limit expenses won’t work if you can’t manage money. Thus, track and manage incomings and outgoings well. As mentioned above, analyse your current expenses and define a route to spending less and earning more. You can do that by cancelling out the unnecessary costs. You can know one when things don’t contribute to life improvement. It could be watching a movie or dining out.

Next, set a budget. Analyse how much you can spend monthly without worries. It is critical for individuals living on a low income. Set limits to your spending. For example- if you earn £15000/month, set a bar at £10000 to be the maximum. Don’t spend more than that. It will help you analyse the amount to save and spend wisely. Moreover, you will be able to save more accordingly.

Bottom line

Thus, do you feel light and confident with finances already? Well, that’s a good sign. Living on a low income is challenging. However, knowing your expenses, income, and goals helps. It is about reducing spending and increasing income and savings. The blog lists ample ways to accomplish these goals. Budgeting may help you with that. You can use a budget planner to understand your requirements well.