Christmas is the busiest time of the year financially for individuals. You need to plan dinner, party, gifts, cake, holidays, etc. All of this requires planning and adequate savings.

One needs to plan all this while battling the cost of living. You cannot skip the basic living requirements nor avoid the festive rush. Thus, what do you do when you need cash urgently?

You may encounter the situation anytime, and it may affect you if you are not prepared. For example, if you see a short circuit, you cannot wait until you get the money from payday. Instead, seek ways to counter the expense within the shortest possible time. The blog lists the solutions to counter urgent home repairs without worries.

Immediate options to cover your requirements

The type of financial options you need to seek depends on the level of urgency. How quickly do you need the funds? If you need it within 1-2 hours, the following options may help:

- Check your home emergency cover

Usually, you may get the services the same day if you have a home emergency cover. It is a separate benefit apart from the home insurance cover. In this, you can carry out the urgent home repairs and call out (plumbers, electricians, and fire extinguishers). You may also get the needed material and get funded by the home emergency cover company. It helps you get help in a timely manner.

- Get Fast cash loans

If you lack home emergency cover, then check other modes to finance the requirements. You can get fast cash loans for everyday needs online. It may help you get up to £5000 without much documentation, collateral or guarantor needs.

You can use it to fund any home repairs during Christmas, like boiler breakdowns, heating and drainage issues. The loan allows you to repay the costs in fixed instalments. It does not affect your basic budget and monthly payments.

- Check your emergency fund

It is a healthy financial habit to save for emergencies. Although a smaller number of individuals have individual emergency funds, it may help you. If you have one, you can use the emergency fund to counter any home repair, including roofing and gutter problems. The amount depends on the area and how much you have in savings. However, avoid tapping the fund frequently as it may affect your ROI.

However, practice saving money into an emergency fund. Choose a fixed amount that you can put towards it without affecting the basic budget. For example, if you save 1000 consistently for 6 months, you can save £6000 plus the interest you get. It thus may be a good opportunity to finance critical emergencies without worries.

- Identify Payday loans possibilities

It is one of the best ways to tackle any financial emergencies in no time. However, you can counter emergencies only up to £1500 here. These loans are backed by the salary and share a 30-day repayment period. Unlike fast loans, you repay the dues in full or as a lump sum after you get your salary.

These loans do not require collateral, a guarantor or a cosigner if you can afford the payments. However, interest rates and terms are more competitive than those of quick loans. Therefore, always explore your options before getting a payday loan.

- Leverage local responsive services

Avoid using national chains during Christmas. Local operators often respond quickly. Here is who may help you out:

- Identify Community trade networks

- Check neighbourhood trade directories

- Check recommendations through local online pages and groups

The best part is- these operators may charge lower fees than the standard operators. You may even get a payment plan if you struggle to pay the dues.

Finance options if you can delay the repairs

If you can delay the repair work for a few days or a week, you can tap into different financial options. It could still be challenging to save amid Christmas, and some repairs don’t wait until February (the next year). Moreover, some critical home repairs could be expensive. The above options may not help you there. Here is what you can do then:

- Check home insurance claim

File a claim for covered damage. However, it may take time to get the reimbursement. It may take a month or a week. Thus, prioritise home repairs and keep the least important and expensive ones for later.

- Home Equity loans

Usually, one delays some home repairs as they require a good cash lump sum. For example, you need to repair the kitchen cabinet’s alignment. Alternatively, caulking and painting the bathroom may be costly too. If you want to construct a loft or additional room within a short span of time, you need money.

One delays these aspects due to the absence of one. However, you can tap into Home equity loans as a homeowner. It may help you leverage the equity in the property to get funds. Later, you can repay the dues in instalments to claim your asset back rightfully.

- Check the energy supplier’s plan

Identify whether your energy supplier offers home repair and maintenance assistance. It could be ideal because you would need to follow up with the person, and it may take time to get the things or repairs done. If it does not work, check small short-term loans with bad credit online. These loans may help you get cash and attend to the important repairs without worries.

Prevention is always better than the cure. It is thus advisable to plan things early. You must keep a safe space for the unpredictable home repairs and needs. It will help you avoid tapping costly finance options like credit cards, loans and overdrafts. Here are some tips that might help:

- DIY small repairs

Before tapping any financial product, check whether someone in the home may help. Yes, some home repairs can be done DIY. It does not require expertise, like changing the lamps or replacing a fuse. It may thus help you save money.

- Attend to the most important repair first

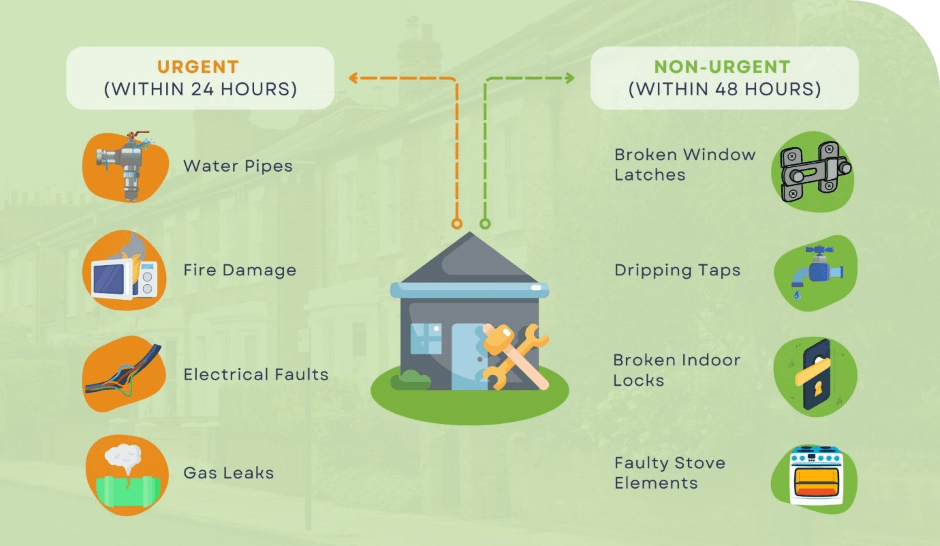

It should be your call to define the urgency and delay in case of home repairs. Plumbing and electricity issues are urgent issues that you should tackle immediately. However, mould formation eradication, painting, and panel repairs can wait.

- Compare quotes

You should not go by the first quote that you receive from the repair company. Wait and analyse your options by authenticating and checking hidden fees.

Bottom line

Thus, dividing your urgent home repair requirements into timelines is important. It helps you analyse, improve the requirement and choose the right funding mode. Fast cash loans and emergency funds help you tackle small cash home repairs. Alternatively, you can turn to secured homes like home equity for non-negotiable but costly repairs.